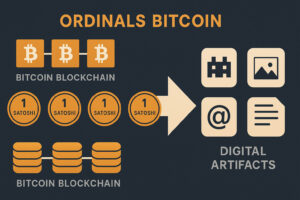

Ordinals bitcoin describes a new method for marking and serializing individual satoshis, the most minute units of bitcoin, in the Bitcoin blockchain. Ordinals Protocol is a name for this technology that enables users to attach singular information in the form of text, images, or other digital objects to individual satoshis, in effect turning them into collectibles or “digital artifacts.” Ordinals bitcoin has inspired a new wave of debate around NFTs (non-fungible tokens) on Bitcoin, blockchain scaling, and novel uses of the network. In this article, we describe the technology, its origins, and the implications and controversies surrounding ordinals bitcoin.

Satoshis transformed into unique digital artifacts with the Ordinals Protocol.

What are Ordinals on Bitcoin?

Ordinals on Bitcoin is a mechanism for uniquely designating and giving value to every satoshi. A satoshi, named for the inventor of Bitcoin, Satoshi Nakamoto, is one hundred millionth of a single bitcoin (0.00000001 BTC). Satoshis existed from the beginning, but the Bitcoin network historically treated them as interchangeable, similar to a piggy bank’s coins. The Ordinals Protocol alters this by assigning a serial number, or “ordinal,” to every satoshi based on when it was mined.

The central concept of ordinals bitcoin is to inscribe a piece of information on a particular satoshi. They refer to this process as “inscription.” An artist, for instance, may inscribe a digital picture on a satoshi, resulting in a novel, verifiable, and sellable digital object on Bitcoin’s blockchain.

Ordinals differ from Ethereum NFTs, which depend on smart contracts, in that they utilize Bitcoin’s native functionality and don’t need to alter the protocol or depend on additional layers. This new application for satoshis has unlocked a new realm for experimentation, collectability, and blockchain creativity in the Bitcoin space.

How the Ordinals Protocol Works

The Ordinals Protocol is an open-source program designed by developer Casey Rodarmor in early 2023. It assigns a specific ordinal number to each satoshi, in the same order that they are mined. It follows the movement of satoshis as they are moved from wallets and spent in transactions.

In order to encode information into a satoshi, users employ a process referred to as “inscription.” They do this by inserting information, including images or text, into Bitcoin’s witness area for a transaction (facilitated by the SegWit upgrade in 2017 and Taproot upgrade in 2021). Information in this manner is now a part of Bitcoin’s blockchain, linked to the particular satoshi by an ordinal number.

This mechanism doesn’t alter the functionality of Bitcoin for regular transactions. It only utilizes existing transaction capabilities in a novel way. Therefore, the Ordinals Protocol enables the creation, purchase, sale, and transfer of digital artifacts, like NFTs, on Bitcoin without a dedicated smart contract system.

The Beginnings and Evolution of Ordinals Bitcoin

The concept of ordinals bitcoin was first conceived by Casey Rodarmor, a software programmer and Bitcoin enthusiast for a number of years. Rodarmor introduced the Ordinals Protocol in January of 2023, opening the door for users to inscribe digital material directly into Bitcoin. The project immediately gained traction from the crypto community. Developers, artists, and enthusiasts experimented with the protocol, producing and trading inscriptions.

In a departure from most prior efforts to bring NFTs to Bitcoin, which typically depended on sidechains or extra layers, ordinals bitcoin functions natively on Bitcoin’s mainnet. The response from the community was swift. Thousands of inscriptions, from simple pixel art and memes to more intricate digital art, were produced in a matter of weeks. The process generated debate regarding network congestion, miner fees, and the implications of storing lots of information on Bitcoin’s blockchain.

Ordinals vs NFTs: Main Differences

A question often asked is whether bitcoin ordinals are merely a variant of NFT, as in those based on Ethereum or Solana. They are similar, yet they are not identical. NFTs on Ethereum use smart contracts and are generally expressed by tokens such as ERC-721 or ERC-1155. These NFTs usually have metadata and images off-chain, and the token references an offchain file. Ordinals bitcoin, by comparison, write the data straight to the Bitcoin blockchain, leaving the artifact forever in the ledger. There is no smart contract here – only the Bitcoin transaction.

Another distinction lies in ownership. Ethereum NFTs are owned by the smart contract, and assets are sometimes impacted by issues such as “rug pulls” or contract glitches. In the ordinals system, ownership is bound up in the satoshi that inscribes the asset, and assets are transferred through ordinary Bitcoin transactions. All of this distinguishes ordinals bitcoin as a novel strategy in digital collectibles, and they occupy a special niche in blockchain and digital art.

Popularity and Community Impact

The debut of the Ordinals Protocol garnered an immediate wave of attention from collectors, developers, and artists. Projects including Ordinal Punks, Taproot Wizards, and a series of generative art collections proliferated, some of which sold for thousands of dollars. Artists welcomed the durability and stability of having digital art consigned on Bitcoin. There were collectors who were attracted by novelty and by the concept of “firsts” – first inscription, first collection, or first meme.

Developers, in response, set about developing wallets, explorers, and marketplaces for ordinals bitcoin, and a mini-ecosystem in Bitcoin took root. Though, the popularity created challenges. Inscriptions led to competition for block space, and, at times, increased transaction fees. There were some members from the Bitcoin community concerned about “blockchain bloat” or spammy information taking over the blockchain. Others believed Bitcoin should still be open to any use that is consistent with its consensus rules, including novel experiments such as ordinals.

Technology behind Ordinals Bitcoin

Several key Bitcoin upgrades are the foundation on which bitcoin relies. They include the SegWit upgrade, which in 2017 enabled more space-efficient storage of transaction information, leaving more space in blocks. Taproot, enabled in 2021, enhanced privacy, flexibility, and storage of information in transactions.

The Ordinals Protocol leverages the “witness” part of a transaction, which is a section for arbitrary information. Here, users are able to write data permanently to the blockchain. The protocol also employs a set of rules to follow in regards to which satoshi is inscribed with which inscription, enabling wallets and explorers to find, render, and send inscribed satoshis.

A number of platforms and tools are now supporting ordinals bitcoin. These are ordinals-enabled wallets (e.g. Xverse and Hiro), block explorers (e.g. ordinals.com and gamma.io), and marketplaces (e.g. for the purchase and sale of inscriptions).

Controversies and Challenges

The bitcoin ordinals phenomenon has caused a stir in the Bitcoin community. Some users and miners appreciate the added demand for block space and the corresponding spike in fees, which secures the network. Others are concerned that the large inscriptions being utilized, particularly images and video, will displace financial transactions or become more expensive for normal users.

There is also the problem of moderation. Since Bitcoin is an uncensored network, anyone is able to write whatever they want, including illegal or controversial stuff. There are issues regarding responsibility, privacy, and the tradeoff between openness and safety.

Finally, scalability is a concern for some developers. The Bitcoin blockchain is not meant to hold large amounts of arbitrary data, and consistent usage of ordinals is liable to push the network close to its capacity. Solutions in the future may include additional technical improvements or off-chain storage solutions.

The Use of Ordinals in the Bitcoin Ecosystem

In spite of controversies, ordinals has opened doors to new possibilities for Bitcoin. It has gained new users, encouraged new discussion about what Bitcoin is capable of, and compelled developers to innovate new tools and techniques. By linking digital art, collectibles, and Bitcoin, ordinals has opened up the discussion to go beyond traditional finance and investment.

Ordinals are viewed by some as evidence of Bitcoin’s resilience and flexibility. Others are concerned about long-term implications and whether the technology will be used responsibly. Regardless, the Ordinals Protocol has put its stamp on the Bitcoin community and will undoubtedly have an effect on future experimentation and innovations.

Conclusion

Ordinals bitcoin is a big leap in Bitcoin evolution, enabling users to write, track, and trade single satoshis as digital collectibles. The Ordinals Protocol leverages major network upgrades, utilizing existing functionality in a new capacity, to build a native, indelible, and collectible framework for digital art and information. Ordinals bitcoin has caused both excitement and trepidation, yet it underscores Bitcoin’s capacity for adaptation, experimentation, and innovation. As the community debates and works on this technology, the tale of ordinals is still in its infancy.

Twitter

Twitter

Telegram

Telegram