Bancor

Bancor Protocol (BNT) is a standard for the creation of Smart Tokens™, cryptocurrencies with built-in convertibility directly through their smart contracts. Now the Bancorp project is one of the most sensational topics in the cryptocurrency community. On June 12, the project team gathered in less than three hours 396 720 ETH. At the exchange rate at that time it is more than $140 million.

Contents

Bancor Review

Tokens Bancor (BNT) in total bought 10885 investors. One of them bought 6,9 million BNT tokens at once, laying out the equivalent of $27 million. In the hands of the team Bancor at one point moved 0.5% ETH from the total. Bancor is going to ensure the exchange of tokens of the ERC20 standard (on the Ethereum blockchain) directly with each other, bypassing the cryptocurrency exchanges.[1] This should increase liquidity in the Ethereum token market and eliminate commissions, and therefore reduce user costs during the exchange. And transactions between different tokens will be carried out with the help of smart contracts. The alpha version of the bancor Protocol is already working, and there is also a software wallet for BNT tokens.

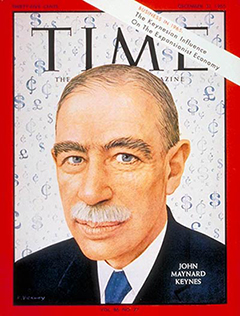

The Bancor was a supranational currency that John Maynard Keynes and E. F. Schumacher[2] conceptualised in the years 1940–1942 and which the United Kingdom proposed to introduce after World War II. The name was inspired by the French banque or (‘bank gold’). This newly created supranational currency would then be used in international trade as a unit of account within a multilateral clearing system—the International Clearing Union—which would also have to be founded.

Bancor Coin and Protocol

John Maynard Keynes proposed an explanation for the ineffectiveness of monetary policy to stem the depression, as well as a non-monetary interpretation of the depression, and finally an alternative to a monetary policy for meeting the depression. Keynes believed that in times of heavy unemployment, interest rates could not be lowered by monetary policies. The ability for capital to move between countries seeking the highest interest rate frustrated Keynesian policies. By closer government control of international trade and the movement of funds, Keynesian policy would be more effective in stimulating individual economies.

Bancor protocol has a built-in pricing mechanism and a liquidity mechanism on its token with respect to any coin on the platform. A special system of reserve and exchange is developed, which allows you to exchange one token to another according to a certain formula. This mechanism is included such a thing as a “permanent reserve ratio”. This decision will help to all holders of the tokens on the Ethereum platform easily ,simply, quickly and with a minimum Commission to do the exchanges.

Bancor would not be an international currency. It would rather be a unit of account used to track international flows of assets and liabilities, which would be conducted through the International Clearing Union. Gold could be exchanged for bancors, but bancors could not be exchanged for gold. Individuals could not hold or trade in bancor. All international trade would be valued and cleared in bancor. Surplus countries with excess bancor assets and deficit countries with excess bancor liabilities would both be charged to provide symmetrical incentives on them to take action to restore balanced trade. In the words of Benn Steil,

Each item a member country exported would add bancors to its ICB account, and each item it imported would subtract bancors. Limits would be imposed on the amount of bancor a country could accumulate by selling more abroad than it bought, and on the amount of bancor debt it could rack up by buying more than it sold. This was to stop countries building up excessive surpluses or deficits. Each country’s limits would be proportional to its share of world trade … Once initial limits had been breached, deficit countries would be allowed to depreciate, and surplus countries to appreciate, their currencies. This would make deficit country goods cheaper, and surplus country goods more expensive, with the aim of stimulating a rebalancing of trade. Further bancor debit or credit position breaches would trigger mandatory action. For chronic debtors, this would include oligatory currency depreciation, rising interest payments to the ICB Reserve Fund, forced gold sales, and capital export restrictions. For chronic creditors, it would include currency appreciation and payment of a minimum of 5 percent interest on excess credits, rising to 10 percent on larger excess credits, to the ICB’s Reserve Fund. Keynes never believed that creditors would actually pay what in effect were fines; rather, he believed they would take the necessary actions … to avoid them.[3]

Bancor Network

The Bancor Network (Bancor), a decentralized cryptocurrency exchange, is launching its native wallet with built-in automated token conversions, Bancor privately told Cointelegraph. The wallet symbolizes the next step in the the company’s development of a liquidity solution aimed at making digital currencies operable by common users, including crypto amateurs. The company claims that users are now able to convert their virtual currencies directly from their wallets, without needing to match two parties in an exchange.

The Bancor Network Token, or BNT, is the hub network token. It activated in June 2017. Users can convert any token within the network to BNT or vice versa. They can use it is an intermediary to convert tokens between each other. The Bancor Formula calculates the rate for these conversions.

Exchanges

Bancor network tokens (BNT) are available on major cryptocurrency exchanges, such as Binance, Bittrex, HitBTC, OKEx, YoBit and etc.

Bancor Wallet

The Bancor’s team have officially released Bancor’s native wallet, enabling users to buy, store and manage any ERC20 token and offering built-in access to token conversions with instant on-chain settlement between any token on the Bancor Network.

Driven by design and built with simplicity in mind, the new wallet (along with Bancor’s new fiat-to-crypto integration via credit card) makes Bancor an end-to-end decentralized solution for frictionless, on-demand access to tokens. New users can create a Bancor Wallet using their Telegram, WeChat or Messenger account, and import any existing ERC20 wallet to start converting instantly. Bancor users who previously created a profile on Bancor now have automatic access to the new wallet. As with all conversions on the Bancor Network, there are no spreads, no deposits and no withdrawal fees when exporting tokens.

Bancor coin price

The price of BNT token or Bancor coin is always chaining, however, BitcoinWiki gives you a chance to see the prices online on Coin360 widget.

Bretton Woods conference

Keynes was able to make his proposal the official British proposal at the Bretton Woods Conference, but it was not accepted. Rather than a supranational currency, the conference adopted a system of pegged exchange rates ultimately tied to physical gold in a system managed by the World Bank and IMF. In practice, the system implicitly established the United States dollar as a reserve currency convertible to gold at a fixed price on demand by other governments. The dollar was implicitly established as the reserve by the large trade surplus and gold reserves held by the US at the time of the conference.

Proposed revival

Since the outbreak of the financial crisis in 2008 Keynes’s proposal has been revived: In a speech delivered in March 2009 entitled Reform the International Monetary System, Zhou Xiaochuan, the governor of the People’s Bank of China called Keynes’s bancor approach “farsighted” and proposed the adoption of International Monetary Fund (IMF) special drawing rights (SDRs) as a global reserve currency as a response to the financial crisis of 2007–2010. He argued that a national currency was unsuitable as a global reserve currency because of the Triffin dilemma—the difficulty faced by reserve currency issuers in trying to simultaneously achieve their domestic monetary policy goals and meet other countries’ demand for reserve currency.[4]

A similar analysis can be found in the Report of the United Nation’s “Experts on reforms of the international monetary and financial system”[5] as well as in the IMF’s study published on 13 April 2010.[6]

The types of smart tokens

- Token changers – smart tokens used for exchange between other tokens of ERC20 standard, which are stored in their reserve.

- ETFS (token Baskets) – smart tokens containing a token package (ERC 20) in reserve and allowing to keep a portfolio of tokens having only one smart token.

- Design and Protocol tokens – smart tokens that you can use for crowdfunding campaigns, where participants receive tokens, which are liquid and have their own value in the market.

All these manipulations can be performed with the help of chatbots Bankor. It is planned that any user without special skills will be able to create a smart token, as well as launch an ICO to implement their ideas.

Advantages

The organizers of the project believe that their tokens will eliminate the need for cryptocurrency exchanges to exchange one token for another. At the same time, there is no “spread” in the system, that is, the difference between the price of buying and selling the token. The advantage of owning BNT tokens is that they allow you to profit from the difference in prices for tokens within the system and “in the outside world” on conventional cryptocurrency exchanges. Bancor also makes it easier to invest in different tokens, allowing you to create “baskets” of several investment instruments. Cooperating with the Token Card project, Bancor also gives the opportunity to link the account in any Windows (as well as smart tokens or investment “baskets”) to a regular Bank card and pay it in the store.

The benefits of the Bancorp:

- infinite liquidity (smart tokens can create, eliminate anyone and anytime)

- backward compatibility (liquidity provision and asynchronous determination of the current token price)

• the lack of spread • no counterparty risk (exchange tokens without using exchanges)

- reduced volatility

- projected price slippage.

Disadvantages

In total, there are 79.3 million BNT tokens, of which investors were able to buy half, that is, 39.6 million tokens. At the same time, it is worth noting that the organizers of the enterprise can at any time arbitrarily increase the number of BNT tokens in circulation. Bancor is also criticized for raising too much money during the ICO. Almost one and a half hundred million dollars: to put it fairly, this amount is excessive for the development of a software product. The distribution of tokens and the procedure of their sale can be long and reasonably criticized — for example, why is this amount taken for the ultimate purpose? And why tokens got not to everyone, but only to the elected, to what this artificial boom? And the main thing-right now actively create a competing Protocol, which is called 0 x Project (“zero-Ex project”). This Protocol has similar objectives. And 0 x Project financial support such famous venture capitalists as a Polychain and Pantera Capital.

See Also on BitcoinWiki

- Blockchain Projects List

- IMF special drawing rights (SDRs)

- Basic Attention Token

- Golem

- ERC20

- BANCOR Network

External Links

- Bancor website

- Bancor on Twitter

- Bancor on Reddit

- Bancor – BitcoinTalk

- Bancor price and market state on Coin360

References

- ↑ Bancor coin review

- ↑ Multilateral Clearing

- ↑ Benn Steil, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order (Princeton: Princeton University Press, 2013), pp. 143-44.

- ↑ Financial Times

- ↑ “Recommendations by the Commission of Experts of the President of the General Assembly on reforms of the international monetary and financial system” (20 March 2009).

- ↑ “Reserve Accumulation and International Monetary Stability” (13 April 2010).